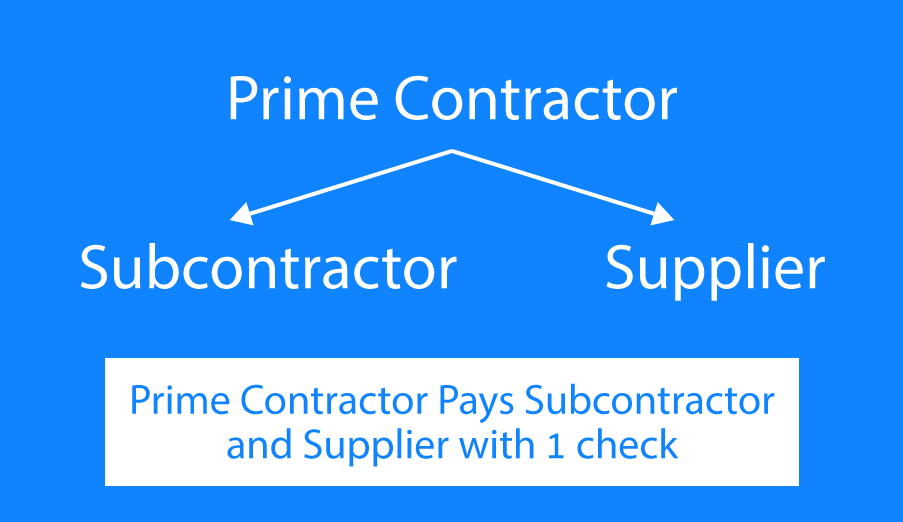

Joint checks are issued in compliance with a Joint Check Agreement. They are designed to protect a general contractor and property owner from lien and bond claims. If you’re a party to a joint check agreement and responsible for writing or depositing a joint check, make sure you pay attention to the details.

For owners, issuing joint checks can be a protection against claims on non-payment and resulting mechanics liens by subcontractors. However, it is wise to make sure there is an appropriate clause in the agreement with the general contractor or a separate agreement that allows joint checks and specifies how much money will be written, to which parties, and how the deposits will be handled. Owners or general contractors may also want to make sure they collect lien waivers from each subcontractor when payment is issued.

Writing a Joint Check

Refer to the joint check agreement for details about how the check should be written. If it needs to be written to two or more companies, be sure to write out the word “and.” You may also want to write the words “jointly” or “as joint payees” to ensure that bankers notice that the check goes to two parties instead of just one. Remember, banks are processing huge volumes of checks every day, so help them make it easier to spot an issue.

If you are responsible for writing lots of joint checks, you may want to get checks that are marked as joint checks with language stating that it is a joint check and the endorsements of all payees are required.

You also want to make sure that the check identifies the specific project it applies to so that those receiving payment can credit it correctly. In addition, the canceled check goes into your records to show that payment was issued appropriately.

Once you’ve written the joint check, think about the best way to deliver it. If there are tension between the parties to the check, it may make sense for you to go with the check to get it endorsed by both parties or letting a contractor make arrangements for obtaining a subcontractor’s endorsement. You may want to require the recipients to execute a lien waiver to help further protect against mechanics liens and bond claims.

Depositing a Joint Check

For a subcontractor, if you’re a party to a joint check agreement, pay attention to the details contained in the agreement covering how you’ll get paid. Often, if the check was written to the general contractor as well as your company, you will drop by the general contractor’s office, endorse the check, and then collect a check in the correct amount. However the details are handled, the endorsements of all parties listed on the check are required to deposit it, which incentives everyone to work together.

If you’re a party to a joint check agreement, or think you’re on a project where one might be a good idea, reach out to the attorneys at National Lien & Bond. We can help you understand the advantages and risks of such agreements and help you put one in place that works for you.

WHY CHOOSE NLB?

WE GET YOU PAID!

Learn More About Mechanics Lien Compliance by State

Gain Access to Our Nationwide Mechanics Lien Construction Lawyers Network

Stay Updated On Legal Compliance Changes in Your State