What is a Miller Act Claim?

A federal construction project is any construction that is done on federal property. This work will be commissioned by a federal entity such as the Army Corps of Engineers, the Department of Veterans Affairs, and others. If you’re the main contractor on a project of this nature, you’ll be required by contract to take out a Miller Act bond. If you’re a sub-contractor on what is clearly a federal project, then you’ll know that a Miller Act Bond Claim is your primary remedy if you don’t get paid on time.

If you’ve worked on a federal construction project furnishing labor or materials and are unpaid for your services, you can fill a Miller Act Claim, which is a bond claim against the federal project created by the US Miller Act. These are used to ensure your company receives timely payment because the company that holds the bond for the project is required to pay your claim if the prime contractor does not. Bond companies are motivated to resolve these issues quickly.

When a federal construction project is started, the prime contractor is required to post the Miller Act bond. This is designed to ensure payment for all subcontractors and material suppliers and a much better mechanism for this purpose than trying to put a lien on federal land. The prime contractor cannot make a claim against the bond, but anyone else who worked on the project can do so.

If you’re working on a federal project, it is wise to get a copy of the Miller Act Bond when you begin working on the project. You request one by providing an affidavit of request to the bond company, who will furnish you with a copy. Having this on hand will speed up your filing process in the event you do need to make a claim.

“If you’re working on a federal project, it is wise to get a copy of the Miller Act Bond when you begin working on the project.”

When to File You Miller Act Claim

The prime contractor cannot file a Miller Act Claim, but first tier contractors and suppliers who worked directly with the prime contractor are eligible to file a claim. First tier contractors and suppliers are not required to send a notice to preserve their rights, although this is good practice and highly recommended. Instead, they have one year from the last date they furnished labor and materials to file a lawsuit against the bond.

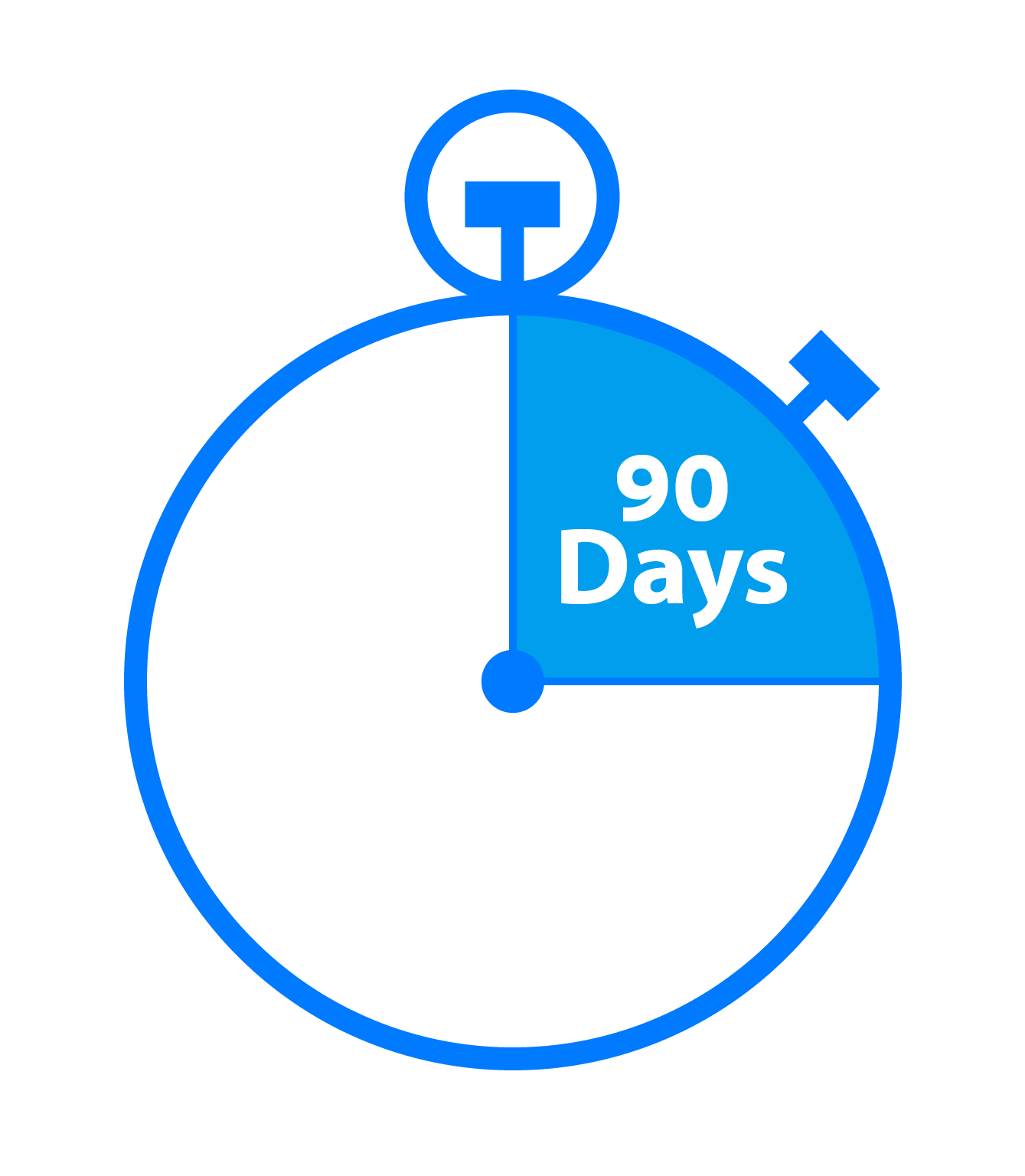

Second-tier contractors are required to file Miller Act bond claims within 90 days of the last date they furnished labor or materials to the project. This 90 day period is a fixed date and claims filed after this date will be denied, so it’s worth paying attention to on your calendar. Second-tier contractors must also file a lawsuit against the bond within one year of their last work date.

According to the US Miller Act, third-tier contractors do not have any rights to file a claim against the bond unless the bond specifically states that they do. This is another reason getting a copy of the bond when you begin working on a project is a good idea as it will let you know what rights you have and when you need to execute them.

For help filing your Miller Act Claim and associated lawsuit, reach out to the attorneys at National Lien & Bond. They have experience working with the bond companies to resolve payment disputes quickly and are prepared to file the appropriate lawsuits on your behalf.

“Second-tier contractors are required to file Miller Act bond claims within 90 days of the last date they furnished labor or materials to the project. “

Why Choose NLB?

Number of Projects

Claim Value

$360,000 ±

Average Claim Value

WE GET YOU PAID!

Learn More About Mechanics Lien Compliance by State

Gain Access to Our Nationwide Mechanics Lien Construction Lawyers Network

Stay Updated On Legal Compliance Changes in Your State

Bond claims are generally used when you’re working on a government construction project. This could be a project for your local municipality or when you’re doing work at the state level. When working on these types of projects, your payment is generally ensured through a bond, so instead of filing a mechanics lien, you file a bond claim.

WHAT IS A BOND CLAIM?

In many ways, bond claims are similar to mechanics liens. They’re used by contractors and materials suppliers to construction projects, are fairly inexpensive to file, and tend to be very effective. A surety company, usually an insurance company that deals in bonds, is responsible for paying for the project in the event the responsible party does not, so there is a strong incentive to make sure you get paid.

WHAT IS THE DIFFERENCE BETWEEN A BOND CLAIM AND A MECHANICS LIEN?

“These are most common when working with governments and public projects. It provides a way to ensure subcontractors can be paid without having to file a lien against government property or a lawsuit against the government. “

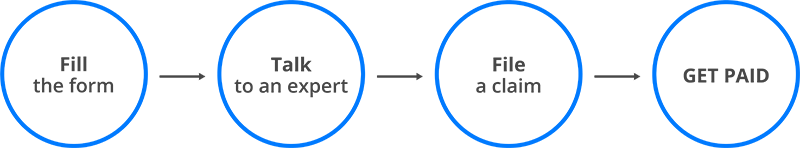

THE PROCESS

File Your Bond Claim:

You start by filing your bond claim. While this sounds simple, there are a number of complex requirements that vary from state to state. You have to comply with each of these requirements in order to make sure your claim is correct and can be enforced. States also have different timelines that cover when the bond claim is due and where they need to be filed.

Submit Your Backup Materials:

When you file a bond claim, the surety company will probably want to see some sort of proof of outstanding payment and collect a sworn statement from you. You’ll need to gather this material for the company quickly to keep your claim moving forward.

Follow-up

Once you’ve filed your information, the surety company will then reach out their customer to notify them of your claim. They’ll request information about your work and claim and try to see if the problem can be resolved. This is often where the process slows down, so be sure to follow up with the surety company regularly and encourage them to approve your claim.

Enforce Your Claim:

If your claim is denied or payment is taking an unreasonable amount of time, you need to start thinking about filing a lawsuit against the surety company. While this is a last step and will certainly cost you more out of pocket, it will certainly get their attention.

NLB'S PROCESS

WHY CHOOSE NLB?

WE GET YOU PAID!

Learn More About Mechanics Lien Compliance by State

Gain Access to Our Nationwide Mechanics Lien Construction Lawyers Network

Stay Updated On Legal Compliance Changes in Your State